Table of Contents

The Shocking Reality: Why Most Crypto Investors Fail 😱

Why 90% of crypto investors stay poor isn’t just a catchy headline – it’s a harsh reality backed by data. While the cryptocurrency market has created countless millionaires, the vast majority of retail investors continue to struggle, losing money despite being part of one of the most lucrative asset classes in history.

The problem isn’t with cryptocurrency itself. Bitcoin has delivered over 160% annual returns on average since its inception. Altcoins like Ethereum have created generational wealth for early adopters. So why do most investors still end up losing money?

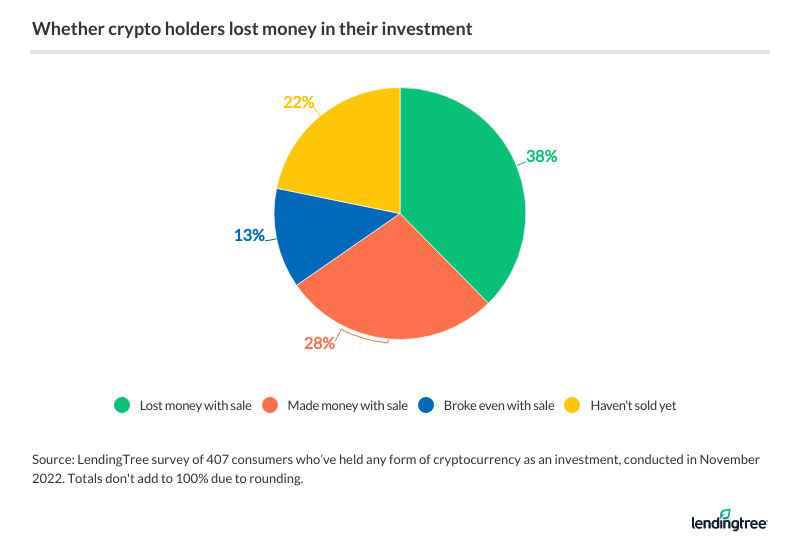

The Numbers Don’t Lie 📊

Recent studies show that approximately 38% of crypto investors have lost more money than they’ve made. Even more alarming, over 90% of day traders lose money within their first year. These statistics paint a clear picture: most people are doing something fundamentally wrong.

The 7 Deadly Mistakes Keeping Investors Poor 💸

1. Emotional Trading: The Wealth Killer 😤

The biggest mistake crypto investors make is letting emotions drive their decisions. FOMO (Fear of Missing Out) leads to buying at peaks, while panic selling during dips locks in losses. Successful investors understand that crypto markets are inherently volatile and plan accordingly.

Why 90% of crypto investors fall into this trap:

- They check prices obsessively

- They make impulsive decisions based on news

- They follow social media hype instead of research

2. Lack of Proper Research 🔍

Most retail investors jump into projects without understanding:

- The technology behind the coin

- The team’s track record

- Real-world use cases

- Tokenomics and supply mechanics

3. No Risk Management Strategy ⚠️

Successful crypto investing requires strict risk management:

- Never invest more than you can afford to lose

- Diversify across different types of cryptocurrencies

- Set stop-losses and take profits systematically

- Follow the 1% rule: never risk more than 1% on a single trade

4. Chasing Quick Gains 🏃♂️

The get-rich-quick mentality destroys more portfolios than any market crash. Altcoins that promise overnight riches are often:

- Pump and dump schemes

- Projects with no real utility

- Tokens with poor tokenomics

5. Ignoring Security Best Practices 🔒

Billions are lost annually to:

- Exchange hacks

- Phishing scams

- Poor wallet security

- Airdrop scams targeting beginners

6. No Long-Term Strategy 📈

Most investors lack a coherent long-term plan:

- They don’t understand market cycles

- They have no clear entry/exit strategy

- They ignore Bitcoin Halving cycles and their impact

7. Following the Wrong Advice 🗣️

Social media influencers and “crypto experts” often:

- Promote projects they’re paid to advertise

- Lack real trading experience

- Give advice that benefits them, not followers

The 10% Secret: What Successful Crypto Investors Do Differently 🎯

Why 90% of crypto investors remain unsuccessful while 10% build substantial wealth comes down to fundamental differences in approach:

1. They Think in Years, Not Days ⏰

Successful crypto investors understand that real wealth is built over time. They:

- Hold quality assets for multiple years

- Understand market cycles and Bitcoin Halving impacts

- Don’t panic during temporary market downturns

2. Dollar-Cost Averaging (DCA) Strategy 💵

Instead of trying to time the market, successful investors:

- Invest fixed amounts regularly regardless of price

- Buy more when prices are low, less when high

- Reduce emotional decision-making

- Benefit from long-term price appreciation

| Time Period | DCA Amount | Average Price | Total Investment | Portfolio Value |

|---|---|---|---|---|

| Year 1 | $500/month | $35,000 | $6,000 | $6,500 |

| Year 2 | $500/month | $45,000 | $12,000 | $15,000 |

| Year 3 | $500/month | $65,000 | $18,000 | $28,000 |

3. Focus on Quality Projects 🏆

The wealthy 10% invest in:

- Bitcoin as a store of value

- Ethereum for smart contract capabilities

- Established altcoins with real utility

- Projects solving actual problems

4. Tax-Efficient Strategies 📋

Smart investors:

- Hold assets for over one year to qualify for long-term capital gains

- Use tax-loss harvesting

- Keep detailed records

- Consider retirement accounts for crypto investing

5. Continuous Learning and Adaptation 📚

Successful crypto investors:

- Stay updated on regulatory changes

- Understand new technologies like DeFi and NFTs

- Learn from mistakes without repeating them

- Follow market cycles and trends

Bitcoin Halving Strategy: The Smart Money Approach 🔄

Bitcoin Halving represents one of the most predictable catalysts in crypto markets. Understanding this cycle is crucial for long-term success.

What is Bitcoin Halving? 🤔

Every four years, the reward for mining new Bitcoin blocks is cut in half. This reduces the supply of new Bitcoin entering the market, creating scarcity.

Recent Halving Events:

- 2024: Reward reduced to 3.125 BTC per block

- 2020: Reward reduced to 6.25 BTC per block

- 2016: Reward reduced to 12.5 BTC per block

Historical Performance After Halvings 📈

| Halving Year | Price at Halving | Peak Price | % Increase | Time to Peak |

|---|---|---|---|---|

| 2012 | $12 | $1,100 | 9,066% | 367 days |

| 2016 | $650 | $20,000 | 2,977% | 525 days |

| 2020 | $8,500 | $69,000 | 712% | 546 days |

Smart Halving Investment Strategy 💡

- Pre-Halving Accumulation: Start buying 12-18 months before halving

- Halving Event: Continue regular purchases regardless of price action

- Post-Halving Patience: Hold through the typical 12-18 month bull run

- Strategic Exit: Take profits systematically as targets are reached

Building Your Crypto Portfolio: The Winning Formula 🏗️

Core Holdings (60-70% of Portfolio) 🏛️

Bitcoin (40-50%)

- Digital gold and store of value

- Most liquid and established cryptocurrency

- Hedge against inflation and currency debasement

Ethereum (20-30%)

- Smart contract platform leader

- Benefits from DeFi and NFT growth

- Ongoing network upgrades improve efficiency

Growth Holdings (20-30% of Portfolio) 🚀

Large Cap Altcoins (15-20%)

- Binance Coin (BNB)

- Solana (SOL)

- Cardano (ADA)

- Polygon (MATIC)

Mid Cap Opportunities (5-10%)

- Emerging DeFi protocols

- Layer 2 solutions

- Gaming and metaverse tokens

Speculative Holdings (5-10% of Portfolio) 🎲

High-Risk, High-Reward

- New airdrop opportunities

- Early-stage projects

- Meme coins (very small allocation)

Warning: Never allocate more than you can afford to lose completely to speculative investments.

Advanced Strategies for Long-Term Wealth 🎯

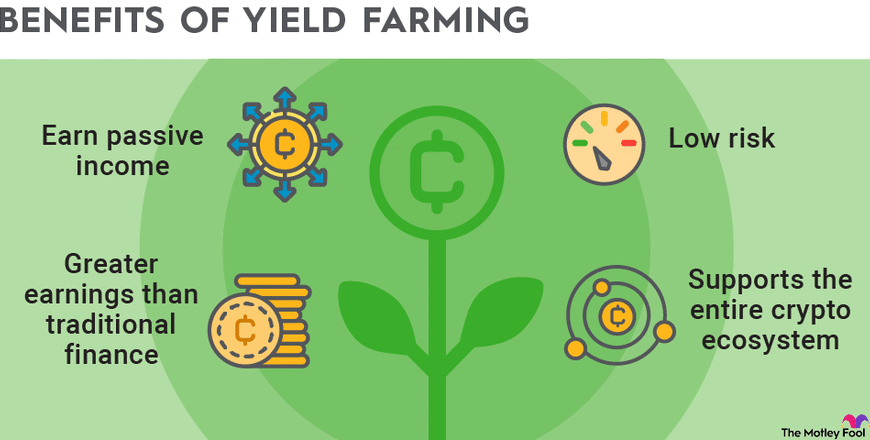

1. Yield Farming and Staking 🌾

Successful investors generate passive income through:

- Staking proof-of-stake cryptocurrencies

- Providing liquidity to decentralized exchanges

- Participating in Binance Launchpool events

- Binance Learn and Earn programs

2. Strategic Diversification 🎪

| Asset Class | Allocation | Purpose |

|---|---|---|

| Bitcoin | 40% | Store of value, inflation hedge |

| Ethereum | 25% | Smart contract exposure |

| Large Cap Alts | 20% | Growth potential, diversification |

| DeFi Tokens | 10% | Yield generation |

| Speculative | 5% | High-risk, high-reward |

3. Market Cycle Awareness 🔄

Understanding crypto’s four-year cycles:

- Accumulation Phase: Bear market, prices low

- Mark-up Phase: Bull market begins

- Distribution Phase: Prices peak, smart money sells

- Mark-down Phase: Bear market returns

4. Technical Analysis Fundamentals 📊

Learn key indicators:

- Moving averages for trend identification

- RSI for overbought/oversold conditions

- Support and resistance levels

- Volume analysis for confirmation

Common Scams and How to Avoid Them 🚨

Identifying Airdrop Scams 🎯

Legitimate airdrops vs. scams:

Legitimate Airdrops:

- No upfront payment required

- Established project with real utility

- Clear tokenomics and distribution plan

- Transparent team and roadmap

Airdrop Scams:

- Require sending cryptocurrency first

- Promise unrealistic returns

- Anonymous teams

- Pressure to act quickly

Rug Pulls and How to Avoid Them 🏃♂️

Red flags for rug pulls:

- Anonymous development team

- No locked liquidity

- Excessive token supply controlled by team

- No real product or utility

- Aggressive marketing without substance

Security Best Practices 🔐

- Use Hardware Wallets: Store significant amounts offline

- Enable 2FA: Two-factor authentication on all accounts

- Verify URLs: Always double-check website addresses

- Private Key Security: Never share or store online

- Regular Updates: Keep software and apps updated

Tax-Efficient Crypto Investing 💰

Understanding Crypto Taxes 📋

Taxable Events:

- Selling crypto for fiat currency

- Trading one cryptocurrency for another

- Using crypto to purchase goods/services

- Receiving crypto from mining or staking

Tax Optimization Strategies:

- Hold assets for over one year (long-term capital gains)

- Harvest tax losses to offset gains

- Consider retirement accounts for crypto exposure

- Keep detailed transaction records

Record Keeping Best Practices 📝

Essential information to track:

- Date and time of each transaction

- Amount and type of cryptocurrency

- USD value at time of transaction

- Transaction fees and costs

- Purpose of transaction

Building Generational Wealth: The Long Game 🏆

The Compound Effect in Crypto 📈

Why 90% of crypto investors miss out on real wealth: they don’t understand compound growth over multiple cycles.

Example of patient investing:

- Initial investment: $10,000

- Average annual return: 100% (conservative for crypto)

- Time horizon: 10 years

- Final value: $10,240,000

Legacy Planning 👨👩👧👦

Successful crypto investors plan for:

- Secure inheritance of digital assets

- Proper documentation for heirs

- Multiple backup strategies

- Legal compliance across jurisdictions

Real-World Success Stories 🌟

Case Study 1: The DCA Millionaire 💎

Sarah, a teacher from Ohio:

- Started with $200/month DCA in 2017

- Focused on Bitcoin and Ethereum only

- Never panic sold during crashes

- Portfolio value in 2025: $2.1 million

Case Study 2: The Cycle Trader 🔄

Mike, understanding Bitcoin Halving cycles:

- Accumulated during 2018-2019 bear market

- Held through 2020-2021 bull run

- Took profits systematically

- Reinvested during 2022-2023 downturn

- Current portfolio: $5.8 million

Your Action Plan: Join the Successful 10% 🎯

Phase 1: Foundation (Months 1-3) 🏗️

- Education: Learn blockchain basics and market cycles

- Security Setup: Hardware wallet and secure practices

- Exchange Account: Choose reputable platforms

- Start Small: Begin with small DCA amounts

Phase 2: Building (Months 4-12) 📈

- Increase Investment: Gradually increase DCA amounts

- Diversification: Add quality altcoins to portfolio

- Yield Generation: Explore staking and Binance Launchpool

- Tax Planning: Implement tax-efficient strategies

Phase 3: Scaling (Year 2+) 🚀

- Advanced Strategies: Options, futures, and DeFi

- International Exposure: Global crypto opportunities

- Alternative Investments: NFTs, gaming tokens

- Legacy Planning: Long-term wealth preservation

Tools and Resources for Success 🛠️

Essential Platforms 📱

Exchanges:

- Binance (comprehensive trading platform)

- Coinbase (beginner-friendly)

- Mexc (Low-Fees)

Tracking Tools:

- CoinTracker (tax reporting)

- Portfolio trackers for performance monitoring

- News aggregators for market updates

Research Resources:

- Project whitepapers and documentation

- On-chain analytics platforms

- Community forums and discussions

⛏️ Want to mine Bitcoin in 2025 without getting wrecked? -> This guide breaks it down step-by-step—no jargon, just results. Dive in now.

Conclusion: Your Path to Crypto Success 🌈

Why 90% of crypto investors remain unsuccessful isn’t a mystery—it’s a choice. The strategies, tools, and knowledge needed for success are available to everyone. The difference lies in discipline, patience, and proper execution.

The cryptocurrency market represents the greatest wealth transfer opportunity in modern history. Bitcoin Halving cycles provide predictable entry points. Altcoins offer tremendous growth potential. Airdrops and Binance Launchpool events create additional income streams.

But success requires:

- ✅ Long-term thinking over quick gains

- ✅ Systematic investing over emotional trading

- ✅ Continuous learning over complacency

- ✅ Risk management over reckless gambling

- ✅ Quality projects over shiny objects

The choice is yours: remain part of the 90% who struggle, or join the elite 10% who build generational wealth through smart crypto investing.

Start today. Your future self will thank you. 🚀

Related External Resources 🔗

- Investopedia’s Guide to Cryptocurrency Investing

- Binance Academy: Crypto Education

- CoinDesk Market Analysis

- Chainalysis Crypto Crime Report

Disclaimer:

Please note that I am a human and human can make mistakes and this information is for educational purposes only. Nothing in this article should be considered financial or investment advice. Cryptocurrencies are volatile and involve substantial risk of loss. Always do your own research before making any investment decisions. Consult with a qualified financial advisor for personalized guidance.

CryptoView.live may contain links to third-party websites or external resources purely for informational purposes. We do not control or endorse the content, accuracy, or offerings of any third-party site linked within our platform. Visitors are strongly encouraged to conduct their own research before engaging with any services or content mentioned. The views expressed on CryptoView.live do not constitute financial advice and reflect the opinions of the authors, not necessarily those of the platform itself.

Have you implemented any of these strategies? Share your crypto journey in the comments below! 💬

Tags: #Bitcoin #Cryptocurrency #Investment #BitcoinHalving #Altcoins #CryptoStrategy #WealthBuilding #DCA #Portfolio #AirdropStrategy

Frequently Asked Questions 🙋♂️

1. Why do 90% of crypto investors really lose money?

Answer: The main reasons include emotional trading (buying high during FOMO, selling low during panic), lack of proper research, no risk management strategy, chasing quick gains instead of long-term growth, and falling for airdrop scams or rug pulls. Most investors also ignore Bitcoin Halving cycles and market patterns that successful investors use to their advantage.

2. What’s the best crypto investment strategy for beginners?

Answer: Start with Dollar-Cost Averaging (DCA) into Bitcoin and Ethereum. Invest only what you can afford to lose, focus 60-70% on established cryptocurrencies, and never invest more than 1% of your portfolio in speculative altcoins. Always use hardware wallets for security and avoid emotional trading decisions.

3. How does Bitcoin Halving affect investment strategy?

Answer: Bitcoin Halving occurs every 4 years and historically leads to significant price increases 12-18 months later. Smart investors start accumulating 12-18 months before halving events, continue buying during the event, and hold through the typical bull run cycle. The 2024 halving has already occurred, making 2025-2026 potentially profitable years.

4. How can I avoid crypto scams and rug pulls?

Answer: Never send cryptocurrency for “guaranteed” returns, research project teams thoroughly, avoid anonymous developers, check if liquidity is locked, and be wary of airdrop scams asking for upfront payments. Stick to established exchanges like Binance, use hardware wallets, enable two-factor authentication, and never share private keys.

5. What percentage of my portfolio should be in cryptocurrency?

Answer: Financial experts recommend 5-10% of your total investment portfolio in cryptocurrency for most investors. Within your crypto allocation: 40-50% Bitcoin, 20-30% Ethereum, 15-20% established altcoins, and only 5-10% in speculative investments. Never invest money you need for essential expenses or can’t afford to lose completely.

Gamebet3 is alright. Not the flashiest site, but it gets the job done. Decent odds, nothing too crazy. Worth a look if you’re shopping around. gamebet3

Fast indexing of website pages and backlinks on Google https://is.gd/r7kPlC