Table of Contents

Introduction: What is Uniswap? 🦄

Uniswap is the world’s most popular decentralized exchange (DEX) that lets you swap cryptocurrencies without using traditional exchanges! 💰 Think of it as a digital marketplace where you can trade tokens directly from your wallet – no middleman required!

Unlike centralized exchanges like Coinbase or Binance, Uniswap operates on blockchain technology and uses smart contracts to execute trades automatically. This means:

- ✅ You control your funds at all times

- ✅ No KYC or registration required

- ✅ Trade 24/7 without restrictions

- ✅ Access to thousands of tokens

- ✅ Lower fees than traditional exchanges

🔍 How Uniswap Works: The Magic Behind DEX

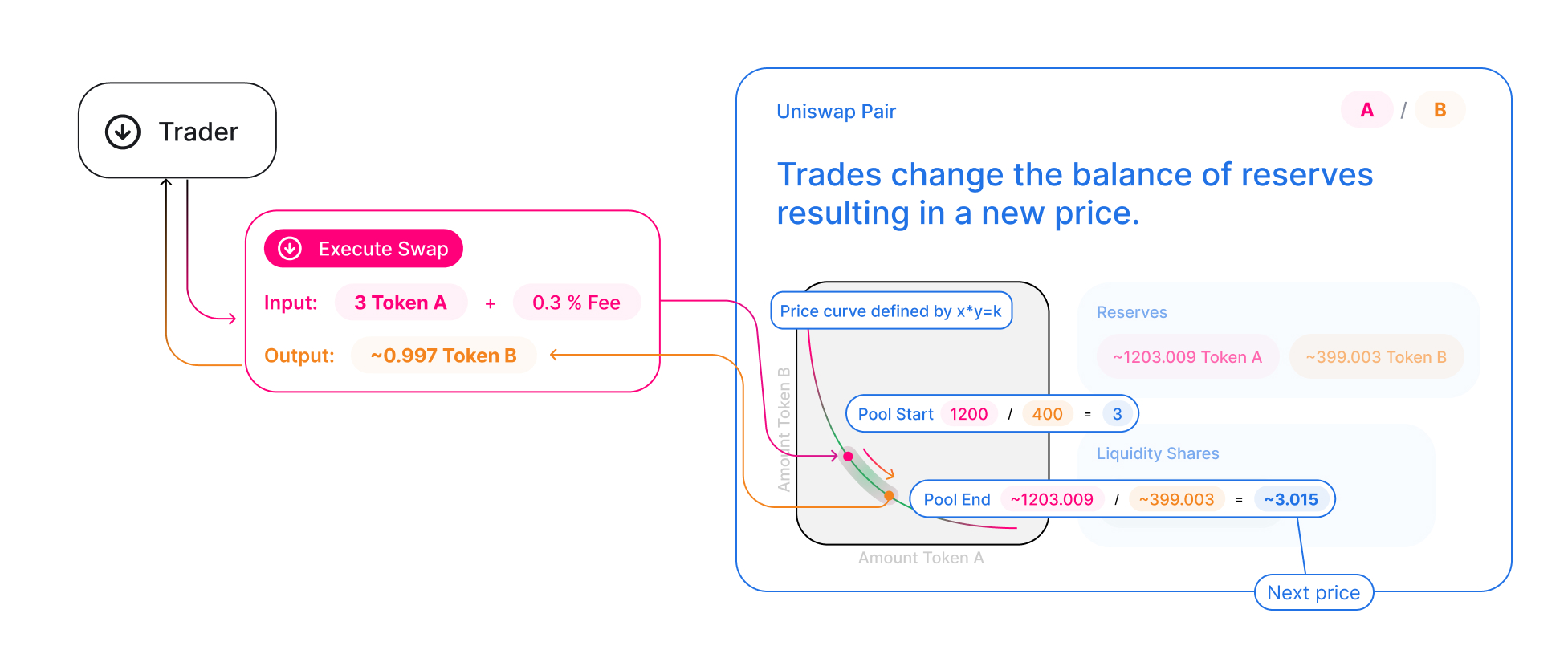

Automated Market Makers (AMM) 🤖

Uniswap doesn’t use traditional order books like stock exchanges. Instead, it uses Automated Market Makers (AMM) that work like this:

Traditional Exchange:

- Buyers and sellers place orders

- Orders matched when prices align

- Limited liquidity for small tokens

Uniswap AMM:

- Liquidity pools contain paired tokens

- Smart contracts calculate prices automatically

- Anyone can provide liquidity and earn fees

Liquidity Pools Explained 💧

Liquidity pools are like digital vaults containing two tokens (like ETH/USDC). When you trade:

- You deposit one token (like ETH)

- Smart contract gives you another (like USDC)

- Pool automatically adjusts prices based on supply/demand

- Liquidity providers earn fees from each trade

🛠️ Getting Started: Your First Uniswap Trade

Step 1: Set Up Your Wallet 👛

Popular Wallet Options:

| Wallet | Type | Best For |

|---|---|---|

| MetaMask | Browser Extension | Beginners |

| Trust Wallet | Mobile App | Mobile Users |

| Coinbase Wallet | Mobile/Desktop | Easy Setup |

| WalletConnect | Protocol | Multiple Wallets |

MetaMask Setup Process:

- Download from official website

- Create new wallet or import existing

- Save your seed phrase safely! 🔒

- Add Ethereum network

- Fund wallet with ETH for gas fees

Step 2: Connect to Uniswap 🔗

- Visit: https://app.uniswap.org

- Click “Connect Wallet”

- Select your wallet type

- Approve connection request

- Your wallet address appears in top-right corner

Step 3: Choose Your Trading Pair 🔄

Popular Trading Pairs:

- ETH → USDC (Ethereum to USD Coin)

- WBTC → ETH (Wrapped Bitcoin to Ethereum)

- UNI → USDT (Uniswap token to Tether)

- DAI → USDC (Stablecoin swapping)

Step 4: Execute Your First Trade 💱

Trading Process:

- Select “From” token (what you’re selling)

- Select “To” token (what you’re buying)

- Enter amount or click “Max”

- Review swap details

- Click “Swap”

- Confirm in your wallet

- Wait for transaction to complete

📊 Understanding Uniswap Fees & Costs

Gas Fees ⛽

What are gas fees? Gas fees are paid to Ethereum miners to process your transaction.

Typical Gas Costs:

- Low traffic: $5-$15 per swap

- Medium traffic: $15-$50 per swap

- High traffic: $50-$200+ per swap

Gas Optimization Tips:

- Trade during off-peak hours

- Use Layer 2 solutions (Arbitrum, Polygon)

- Batch multiple transactions

- Monitor gas prices with tools like GasTracker

Trading Fees 💸

Uniswap V3 Fee Structure:

- 0.05% – Stablecoin pairs

- 0.30% – Standard pairs

- 1.00% – Exotic pairs

Fee Distribution:

- 100% goes to liquidity providers

- No platform fees (unlike centralized exchanges)

🎯 Advanced Uniswap Features

Limit Orders 📈

What are limit orders? Buy or sell tokens at specific prices instead of current market prices.

How to place limit orders:

- Switch to “Limit” tab

- Set your desired price

- Choose expiration time

- Submit order

- Order fills when price is reached

Liquidity Providing 💰

Become a liquidity provider to earn fees!

Steps to provide liquidity:

- Click “Pool” tab

- Select “New Position”

- Choose token pair

- Set price range (V3 feature)

- Deposit both tokens

- Earn fees from trades

Liquidity Provider Benefits:

- ✅ Earn trading fees (0.05% to 1.00%)

- ✅ Potential airdrop farming opportunities

- ✅ Support DeFi ecosystem

- ✅ Higher yields than traditional savings

Risks to Consider:

- ⚠️ Impermanent loss

- ⚠️ Token price volatility

- ⚠️ Smart contract risks

Uniswap V3 Concentrated Liquidity 🎲

V3 Innovation:

- Provide liquidity in specific price ranges

- Higher capital efficiency

- Potentially higher fees

- More complex position management

🛡️ Security Best Practices

Wallet Security 🔒

Essential Security Tips:

- Never share your seed phrase

- Use hardware wallets for large amounts

- Verify contract addresses before trading

- Start with small amounts when learning

- Keep software updated

Avoiding Scams 🚨

Common airdrop scams to avoid:

- Fake token airdrops

- Phishing websites

- “Too good to be true” returns

- Unverified smart contracts

Tips to Avoid Crypto Scams in 2025

**How to avoid rug pulls:

- Check token liquidity

- Verify team information

- Research project thoroughly

- Use tools like RugDoc

- Never invest more than you can lose

🌟 Best Airdrops 2025 Strategy

Uniswap Ecosystem Airdrops 🎁

Potential airdrop opportunities:

- Layer 2 protocols (Arbitrum, Optimism)

- New DEX launches on different chains

- Governance tokens for active traders

- Bridge protocols for multi-chain trading

Airdrop farming tips:

- Trade regularly on different networks

- Provide liquidity to new pools

- Vote in governance proposals

- Bridge tokens between chains

- Use new features early

📱 Mobile Trading with Uniswap

Uniswap Mobile App 📲

Features:

- Full trading functionality

- Portfolio tracking

- Price alerts

- NFT support

- Multi-chain support

Download Links:

- iOS App Store

- Google Play Store

- APK from official website

Mobile Trading Tips 💡

Best practices:

- Use strong device passwords

- Enable biometric authentication

- Trade on secure networks only

- Keep app updated

- Backup wallet regularly

🔄 Bridge to Solana and Multi-Chain Trading

Cross-Chain Opportunities 🌉

Popular bridge protocols:

- Wormhole – Solana bridge

- Hop Protocol – Layer 2 bridges

- Synapse – Multi-chain bridge

- Celer Bridge – Fast transfers

Benefits of multi-chain trading:

- Lower fees on alternative chains

- Access to unique altcoins

- Diversified DeFi opportunities

- Arbitrage possibilities

📈 Token Analysis & Research

Finding Biggest Coin Movers 🎯

Research Tools:

- CoinGecko – Price tracking

- DeFiPulse – Protocol analytics

- Dune Analytics – On-chain data

- CoinMarketCap – Market data

Key metrics to analyze:

- Trading volume

- Liquidity depth

- Price volatility

- Market capitalization

- Community activity

24h Crypto Change Tracking 📊

Important indicators:

- Price movements

- Volume changes

- Liquidity shifts

- Social sentiment

- Technical patterns

🎓 Learning Resources

Educational Content 📚

Official Resources:

- Uniswap Documentation

- Discord community

- Twitter updates

- YouTube tutorials

- Blog posts

Third-party Learning:

- DeFi education platforms

- Crypto YouTube channels

- Community forums

- Practice with testnet

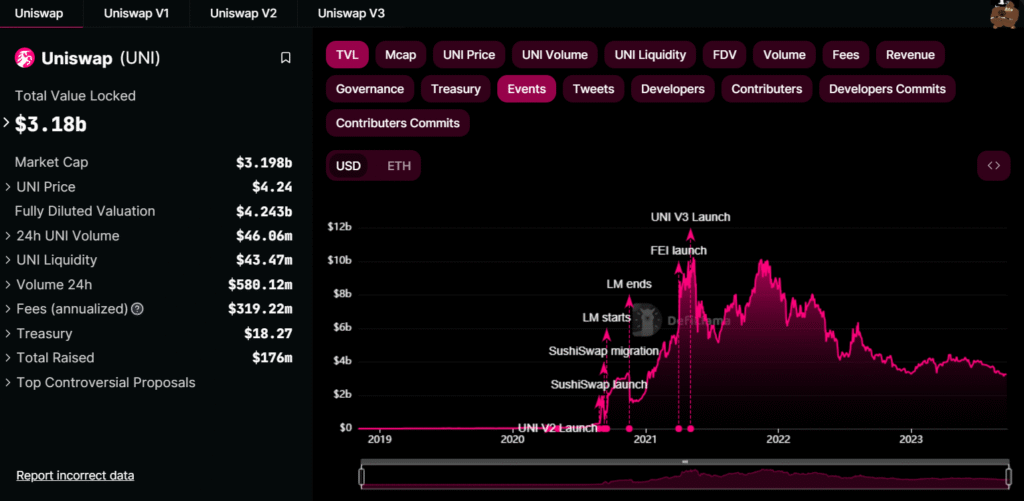

🚀 Future of Uniswap

Upcoming Developments 🔮

Roadmap highlights:

- Uniswap V4 with hooks

- Layer 2 expansion

- Cross-chain functionality

- Improved user experience

- Mobile app enhancements

Market Trends 📈

Industry developments:

- Institutional adoption

- Regulatory clarity

- Bitcoin integration

- Blockchain scalability

- Mobile-first design

💡 Pro Trading Tips

Maximizing Profits 💰

Advanced strategies:

- Dollar-cost averaging

- Swing trading

- Arbitrage opportunities

- Yield farming

- Staking rewards

Risk Management 🛡️

Essential practices:

- Set stop losses

- Diversify holdings

- Research thoroughly

- Start small

- Keep learning

🎯 Conclusion: Start Your DeFi Journey

Uniswap has revolutionized cryptocurrency trading by making it decentralized, accessible, and profitable for everyone! 🌟

Key takeaways:

- ✅ No registration required – just connect wallet

- ✅ Trade thousands of tokens directly

- ✅ Earn fees by providing liquidity

- ✅ Complete control over your funds

- ✅ 24/7 trading without restrictions

Getting Started Checklist ✅

Before you begin:

- Set up secure wallet

- Fund with ETH for gas fees

- Start with small amounts

- Research tokens thoroughly

- Understand fee structures

- Practice on testnet first

Safety Reminders 🔒

Always remember:

- Never share private keys

- Verify contract addresses

- Use official Uniswap app

- Keep software updated

- Invest responsibly

Ready to start trading? Visit https://app.uniswap.org and connect your wallet to begin your DeFi journey! 🚀

This guide provides educational information about Uniswap and decentralized trading. Always do your own research and consider consulting with financial professionals before making investment decisions. Cryptocurrency trading involves risks, and you should never invest more than you can afford to lose.

Disclaimer:

Please note that I am a human and human can make mistakes and this information is for educational purposes only. Nothing in this article should be considered financial or investment advice. Cryptocurrencies are volatile and involve substantial risk of loss. Always do your own research before making any investment decisions. Consult with a qualified financial advisor for personalized guidance.

CryptoView.live may contain links to third-party websites or external resources purely for informational purposes. We do not control or endorse the content, accuracy, or offerings of any third-party site linked within our platform. Visitors are strongly encouraged to conduct their own research before engaging with any services or content mentioned. The views expressed on CryptoView.live do not constitute financial advice and reflect the opinions of the authors, not necessarily those of the platform itself.

What is Uniswap?

Uniswap is a decentralized exchange (DEX) built on the Ethereum blockchain that allows users to swap ERC-20 tokens directly from their wallets without intermediaries.

How do I start trading on Uniswap?

To start trading:

Install a Web3 wallet like MetaMask.

Fund it with ETH.

Connect your wallet to Uniswap.

Choose the tokens you want to swap and confirm the transaction.

Is Uniswap safe for beginners?

Yes, Uniswap is non-custodial, meaning you retain control of your funds. However, always double-check token contracts and beware of scams.

What are gas fees on Uniswap?

Gas fees are transaction costs on the Ethereum network. They vary based on network congestion and can be high during peak times.

Can I use Uniswap on mobile?

Yes, you can use Uniswap through mobile wallets like Trust Wallet or MetaMask Mobile, which have built-in DApp browsers.

Do I need to register or verify my identity?

No. Uniswap is decentralized and doesn’t require KYC (Know Your Customer) verification.

https://shorturl.fm/AKCZN

เนื้อหาที่น่าพิจารณา, ทำให้ฉันคิดในแง่มุมใหม่ๆ.

Ꭺlso visit my wеb blⲟg – play poker in Thailand

Fast indexing of website pages and backlinks on Google https://is.gd/r7kPlC