Hey crypto fam! 😎 After a brief dip below $99K, Bitcoin is charging back with strength — and the whole crypto market seems to be picking up speed right behind it.

With easing global tensions and bullish momentum across traditional markets, investors are once again betting big on digital assets. Let’s break it down.

Table of Contents

🔥 Bitcoin Reclaims $106K: Safe Haven Vibes?

Bitcoin has bounced above $106,000, shrugging off last week’s drop. Analysts now believe BTC is behaving more like digital gold — a hedge against uncertainty.

According to Bitget’s Ryan Lee, massive ETF inflows — over $46 billion — show growing investor confidence. He’s predicting Bitcoin could hit $110K–$115K by Q3, with potential highs of $130K to even $160K by the end of the year. That’s serious moonshot energy! 🌕

Source: Unknown

🚀 Altcoins Waking Up: Ethereum, Solana, Cardano Lead the Way

Bitcoin isn’t rallying alone. Several major altcoins are heating up too:

- Ethereum (ETH): Hovering around $2,400 with upward potential toward $2,600–$2,800. Long-term outlook? As high as $5,500.

- Solana (SOL): Holding strong at $145 — developers and DeFi projects love its speed.

- Cardano (ADA): Down slightly to $0.58, but testing key support levels.

- Dogecoin (DOGE): Trading at $0.16 — meme power never fades 🐶

🌍 Why the Bullish Shift?

Here’s what’s fueling crypto’s renewed momentum:

- Ceasefire Hopes: Tensions easing in the Middle East = lower global risk = renewed investor appetite.

- Stock Market Rally: Nasdaq just hit a record close, and crypto often follows equity sentiment.

- Fed Pivot Talk: Jerome Powell hinted at “multiple paths” forward, signaling possible interest rate cuts ahead — great news for non-yielding assets like Bitcoin.

🧠 Is Bitcoin Truly Becoming a Safe Haven?

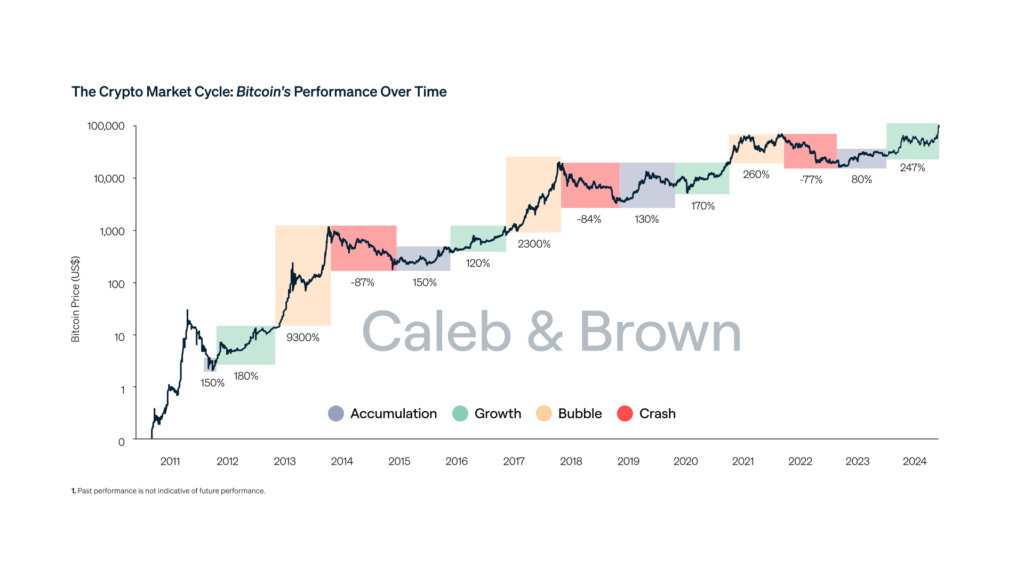

BTC’s sharp recovery has reignited debate. While crypto still reacts to macro events, institutional buying is helping stabilize price swings.

Gadi Chait from Xapo Bank notes that Bitcoin’s “V-shaped bounce” over $105K within 48 hours shows growing maturity and liquidity — a sign it’s no longer just a speculative bet.

🔮 What’s Next?

If current momentum holds, Bitcoin could test $110K soon — and push toward that $160K milestone isn’t far-fetched. With altcoins aligning and global sentiment easing, the second half of 2025 could bring serious fireworks.

What do you think? Will Bitcoin smash through $160K before the year ends? Stay tuned to CryptoView for daily updates — and don’t forget to HODL smart! 💥📲

✨ Ever Dreamed of Creating Your Own Bitcoin? Here’s How to Make It Happen! 🚀

Wanna launch your own crypto token like BTC? Check out this step-by-step guide and start building your digital empire today! 💰🧠

Can Bitcoin really hit $160K by the end of the year?

Experts like Ryan Lee from Bitget predict Bitcoin could reach $130K–$160K by year-end if current momentum continues. Factors like ETF inflows and macroeconomic shifts are fueling this optimism.

Why is Bitcoin rebounding above $106K?

Bitcoin’s recent recovery is driven by strong institutional inflows, easing global tensions, and renewed investor confidence. Analysts believe it’s behaving more like a safe-haven asset, similar to gold.

Which altcoins are showing bullish signs?

Ethereum (ETH), Solana (SOL), Cardano (ADA), and Dogecoin (DOGE) are among the altcoins gaining traction. ETH is targeting $2,600–$5,500, while SOL remains strong at $145.

How does global sentiment affect the crypto market?

Events like ceasefires, stock market rallies, and potential interest rate cuts by the Fed reduce risk aversion, encouraging investors to allocate funds to crypto assets.

Is Bitcoin becoming a safe-haven asset?

Bitcoin’s sharp recovery and institutional buying suggest it’s maturing as a hedge against uncertainty. Analysts note its liquidity and stability are improving, making it more reliable during volatile times.

ETF Data ➡️ Link Text: “Latest Bitcoin ETF flows from Bitget Research” ➡️ Link To: research (or official ETF data source)

“Create your free Binance account here” LINK ⬅️

Please note:–

CryptoView.live may contain links to third-party websites or external resources purely for informational purposes. We do not control or endorse the content, accuracy, or offerings of any third-party site linked within our platform. Visitors are strongly encouraged to conduct their own research before engaging with any services or content mentioned. The views expressed on CryptoView.live do not constitute financial advice and reflect the opinions of the authors, not necessarily those of the platform itself.

Disclaimer:

Please note that I am a human and human can make mistakes and this information is for educational purposes only. Nothing in this article should be considered financial or investment advice. Cryptocurrencies are volatile and involve substantial risk of loss. Always do your own research before making any investment decisions. Consult with a qualified financial advisor for personalized guidance.