Table of Contents

Table of Contents

💡 What is Bitcoin Mining?

Bitcoin mining is like a digital treasure hunt where computers solve complex math puzzles to earn Bitcoin rewards. Think of it as the backbone of the entire Bitcoin network – without miners, Bitcoin simply wouldn’t exist!

🎯 Key Points About Bitcoin Mining:

- Validates transactions on the blockchain network

- Creates new bitcoins through block rewards

- Secures the network through proof-of-work

- Requires specialized hardware called ASIC miners

- Consumes significant energy for computational power

Mining serves two main purposes: processing Bitcoin transactions and introducing new bitcoins into circulation. Every 10 minutes, miners compete to solve a mathematical puzzle, and the winner gets to add a new block to the blockchain.

⚙️ How Does Bitcoin Mining Work?

The Bitcoin mining process might sound complicated, but let’s break it down into simple terms that anyone can understand.

🔍 The Basic Concept

Imagine thousands of people trying to guess a secret number. The first person to guess correctly wins a prize (Bitcoin reward). But here’s the twist – the only way to find this number is by trying millions of different combinations until you get lucky!

🧮 Mathematical Problem Solving

Bitcoin uses something called SHA-256 hashing. Here’s what happens:

- Transaction Collection: Miners gather pending Bitcoin transactions

- Block Creation: They bundle these transactions into a “block”

- Hash Generation: The mining computer creates a unique fingerprint (hash) for this block

- Difficulty Target: The hash must be smaller than a specific target number

- Trial and Error: Miners keep changing a small number (nonce) until they find the right hash

📊 Mining Statistics Table

| Mining Metric | Current Value (2024) |

|---|---|

| Block Reward | 6.25 BTC |

| Block Time | ~10 minutes |

| Network Hashrate | ~500 EH/s |

| Mining Difficulty | Adjusts every 2016 blocks |

| Energy Consumption | ~150 TWh annually |

🖥️ Mining Equipment Required

Getting started with Bitcoin mining requires the right tools. Here’s what you need:

🔧 Essential Mining Hardware

1. ASIC Miners (Application-Specific Integrated Circuits)

These are specialized computers built specifically for Bitcoin mining:

- Antminer S19 Pro: 110 TH/s hashrate, 3250W power

- Whatsminer M30S++: 112 TH/s hashrate, 3472W power

- AvalonMiner 1246: 90 TH/s hashrate, 3420W power

2. Power Supply Units (PSU)

Mining rigs consume massive amounts of electricity:

- High-efficiency PSUs (80+ Gold or Platinum rated)

- Adequate wattage to handle your mining rig

- Stable power delivery for 24/7 operations

3. Cooling Systems

Mining generates tremendous heat:

- Industrial fans for air circulation

- Air conditioning for temperature control

- Proper ventilation to prevent overheating

💻 Software Requirements

- Mining pool software (like Slushpool, F2Pool)

- Mining management software (like Awesome Miner)

- Bitcoin wallet to receive rewards

- Monitoring tools for performance tracking

📋 Step-by-Step Mining Process

Let’s walk through exactly what happens during Bitcoin mining:

Step 1: 🔄 Transaction Collection

Miners collect unconfirmed transactions from the mempool (memory pool). These are Bitcoin transfers waiting to be processed.

Step 2: 🏗️ Block Construction

Selected transactions are arranged into a block structure containing:

- Block header with previous block reference

- Merkle tree of all transactions

- Timestamp and difficulty target

- Nonce (number used once)

Step 3: 🎲 Hash Generation

The mining computer calculates the SHA-256 hash of the block header. This creates a unique 64-character fingerprint.

Step 4: ✅ Difficulty Check

The generated hash is compared against the current difficulty target. If it’s smaller than the target, the miner wins!

Step 5: 🏆 Block Broadcast

The winning miner broadcasts their solution to the network. Other nodes verify and accept the new block.

Step 6: 💰 Reward Collection

The successful miner receives:

- Block reward: Currently 6.25 BTC

- Transaction fees: Additional Bitcoin from users

⚡ Energy Consumption Facts

Bitcoin mining’s energy usage has become a hot topic. Let’s examine the real numbers:

🌍 Global Energy Usage

According to the Cambridge Bitcoin Electricity Consumption Index, Bitcoin mining consumes approximately 150 terawatt-hours (TWh) annually. To put this in perspective:

- Equal to the annual electricity consumption of Argentina

- Represents about 0.5% of global electricity usage

- Uses more energy than some entire countries

💡 Energy Efficiency Improvements

| Year | Energy per Transaction | Mining Efficiency |

|---|---|---|

| 2017 | 950 kWh | 0.1 J/GH |

| 2020 | 740 kWh | 0.03 J/GH |

| 2024 | 703 kWh | 0.02 J/GH |

🔋 Power Source Breakdown

- Renewable Energy: ~39% (hydroelectric, solar, wind)

- Natural Gas: ~30%

- Coal: ~20%

- Nuclear: ~11%

The Bitcoin mining industry is increasingly moving toward renewable energy sources to reduce environmental impact.

💰 Mining Rewards & Profitability

Understanding mining economics is crucial for anyone considering entering this space.

🎁 Current Reward Structure

Block Reward: 6.25 BTC (as of 2024)

- This amount halves approximately every 4 years

- Next halving expected in 2028 (reward will become 3.125 BTC)

Transaction Fees: Variable (typically 0.1-2 BTC per block)

- Fees increase during network congestion

- Provides additional income for miners

📈 Profitability Factors

Revenue Factors:

- Bitcoin price in USD

- Mining difficulty adjustments

- Transaction fee levels

- Block discovery luck

Cost Factors:

- Electricity rates (usually 50-70% of total costs)

- Hardware depreciation

- Cooling and maintenance

- Pool fees (if applicable)

💵 Profitability Calculation Example

For an Antminer S19 Pro:

Daily Revenue: ~$15-25 (varies with BTC price)

Daily Electricity Cost: ~$18-22 (at $0.10/kWh)

Net Daily Profit: -$3 to +$7Note: Profitability varies significantly based on electricity costs and Bitcoin price fluctuations.

⏰ Bitcoin Halving Impact

The Bitcoin Halving is one of the most important events in the Bitcoin ecosystem, directly affecting miners.

📅 Halving Schedule

| Halving Event | Date | Block Reward |

|---|---|---|

| Genesis | 2009 | 50 BTC |

| First Halving | 2012 | 25 BTC |

| Second Halving | 2016 | 12.5 BTC |

| Third Halving | 2020 | 6.25 BTC |

| Next Halving | ~2028 | 3.125 BTC |

🎯 Economic Impact

Immediate Effects:

- 50% reduction in mining revenue

- Increased competition among miners

- Some miners exit if unprofitable

Long-term Effects:

- Reduced Bitcoin supply growth

- Potential price increases due to scarcity

- Mining industry consolidation

Historical data shows that Bitcoin price often increases significantly in the 12-18 months following each halving event, though past performance doesn’t guarantee future results.

🌱 Environmental Impact

The environmental debate around Bitcoin mining is complex and evolving.

🌍 Carbon Footprint Analysis

Annual Estimates:

- CO2 Emissions: ~65 million tons annually

- Comparable to: Countries like Greece or Argentina

- Per Transaction: ~400-800 kg CO2

🔄 Sustainability Initiatives

Renewable Energy Adoption:

- Hydroelectric: Major mining operations in regions with cheap hydro power

- Solar & Wind: Growing adoption in sunny and windy regions

- Stranded Energy: Utilizing otherwise wasted energy sources

Carbon Offsetting:

- Some mining companies purchase carbon credits

- Investment in reforestation projects

- Development of carbon-neutral mining facilities

♻️ Positive Environmental Aspects

- E-waste Reduction: Efficient ASIC miners last 3-5 years

- Grid Stabilization: Mining can help balance electrical grids

- Renewable Investment: Mining profits fund renewable energy projects

🔮 Future of Bitcoin Mining

The Bitcoin mining landscape continues to evolve rapidly.

🚀 Technological Advances

Hardware Improvements:

- Next-gen ASIC chips with better efficiency

- Immersion cooling systems for better performance

- Modular mining containers for easier deployment

Software Innovations:

- AI-optimized mining operations

- Predictive maintenance systems

- Automated pool switching for maximum profitability

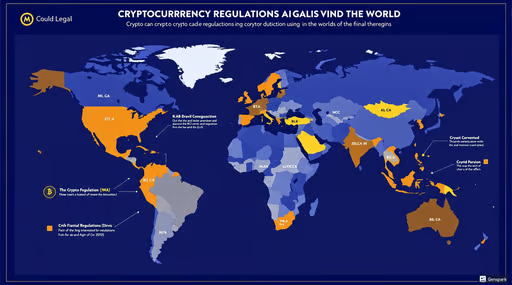

🏛️ Regulatory Landscape

Supportive Regions:

- United States: Generally crypto-friendly policies

- Kazakhstan: Major mining destination

- Canada: Abundant renewable energy

Restrictive Regions:

- China: Complete mining ban since 2021

- Some EU countries: Considering restrictions

🌐 Industry Trends

- Large-scale Operations: Trend toward industrial-sized mining farms

- ESG Focus: Environmental, Social, Governance considerations

- Integration with Renewables: Mining as grid stabilization tool

- Geographical Distribution: Mining spreading globally for decentralization

📊 Mining Difficulty Predictions

As more miners join the network, difficulty automatically adjusts every 2016 blocks (~2 weeks) to maintain the 10-minute block time target.

🎯 Key Takeaways

✨ Important Points to Remember:

- Bitcoin mining secures the network and processes transactions

- Specialized hardware (ASIC miners) required for profitable mining

- Energy consumption is significant but increasingly renewable

- Profitability depends heavily on electricity costs and Bitcoin price

- Mining rewards decrease over time due to halving events

- Environmental impact is improving with renewable energy adoption

🔗 Getting Started Tips:

- Calculate costs carefully before investing in mining equipment

- Research electricity rates in your area

- Consider cloud mining as an alternative to hardware ownership

- Join mining pools to reduce variance in earnings

- Stay updated on difficulty adjustments and market conditions

🌟 Final Thoughts

Bitcoin mining represents the foundation of the world’s first decentralized digital currency. While it requires significant investment and technical knowledge, understanding how mining works helps you appreciate the innovation behind Bitcoin and blockchain technology.

Whether you’re considering becoming a miner or simply want to understand how Bitcoin operates, remember that mining is both an economic activity and a crucial component of Bitcoin’s security model. As the industry matures, we can expect continued improvements in efficiency, sustainability, and accessibility.

The future of Bitcoin mining looks bright, with ongoing innovations in hardware, renewable energy adoption, and regulatory clarity paving the way for a more sustainable and decentralized financial system.

Ready to start mining? Use our free profitability calculator and join the CryptoView Discord for live alerts, hardware tips, and mining pool recommendations. 🚀

📚 External Resources:

Read our Latest article👈

Tags: Bitcoin, blockchain, cryptocurrency mining, ASIC miners, proof-of-work, energy consumption, Bitcoin halving, renewable energy, mining profitability

Disclaimer:

Please note that I am a human and human can make mistakes and this information is for educational purposes only. Nothing in this article should be considered financial or investment advice. Cryptocurrencies are volatile and involve substantial risk of loss. Always do your own research before making any investment decisions. Consult with a qualified financial advisor for personalized guidance.

CryptoView.live may contain links to third-party websites or external resources purely for informational purposes. We do not control or endorse the content, accuracy, or offerings of any third-party site linked within our platform. Visitors are strongly encouraged to conduct their own research before engaging with any services or content mentioned. The views expressed on CryptoView.live do not constitute financial advice and reflect the opinions of the authors, not necessarily those of the platform itself.

❓ FAQ Section

Q1: What is Bitcoin mining in 2025?

Bitcoin mining is the process of validating transactions on the blockchain using specialized hardware (ASICs). Miners solve complex puzzles to earn BTC rewards and secure the network.

Q2: Is Bitcoin mining still profitable in 2025?

Yes, but profitability depends on electricity costs, mining difficulty, and BTC price. Efficient setups and cheap power sources are key.

Q3: What hardware is needed for mining in 2025?

ASIC miners like Antminer S21 or WhatsMiner M60 are essential. GPUs and CPUs are no longer viable for Bitcoin mining.

Q4: Can beginners start mining in 2025?

Beginners can start with cloud mining or join mining pools. Solo mining requires high investment and technical expertise.

Q5: What are the best countries for mining in 2025?

El Salvador, Iceland, and Texas (USA) offer cheap electricity and favorable regulations.

Alright, who’s tried 111bets? Their site looks pretty clean. Any hidden bonuses or things I should know about before signing up? Let me know! Check it out here: 111bets