Master the art of earning passive income through cryptocurrency yield farming with this comprehensive guide

Table of Contents

🌟 Introduction

Welcome to the exciting world of yield farming! 🌾 If you’ve been wondering how to make your crypto work harder for you, you’re in the right place. Yield farming has become one of the hottest trends in the cryptocurrency space, offering investors a way to earn passive income from their digital assets.

In this comprehensive guide, we’ll break down everything you need to know about yield farming in simple terms. Whether you’re a complete beginner or looking to expand your knowledge, this article will help you understand how to potentially maximize your crypto returns in 2025.

🤔 What is Yield Farming?

Yield farming, also known as liquidity mining, is a process where cryptocurrency holders lend or stake their digital assets in DeFi (Decentralized Finance) protocols to earn rewards. Think of it as putting your money in a high-interest savings account, but instead of traditional banks, you’re using blockchain-based platforms.

🎯 Key Features of Yield Farming:

- Passive Income Generation 💰

- Decentralized Platform Usage 🌐

- Liquidity Pool Participation 🏊♂️

- Smart Contract Automation 🤖

- Multiple Reward Types 🎁

🔧 How Does Yield Farming Work?

Understanding how yield farming works is crucial for success. Here’s a step-by-step breakdown:

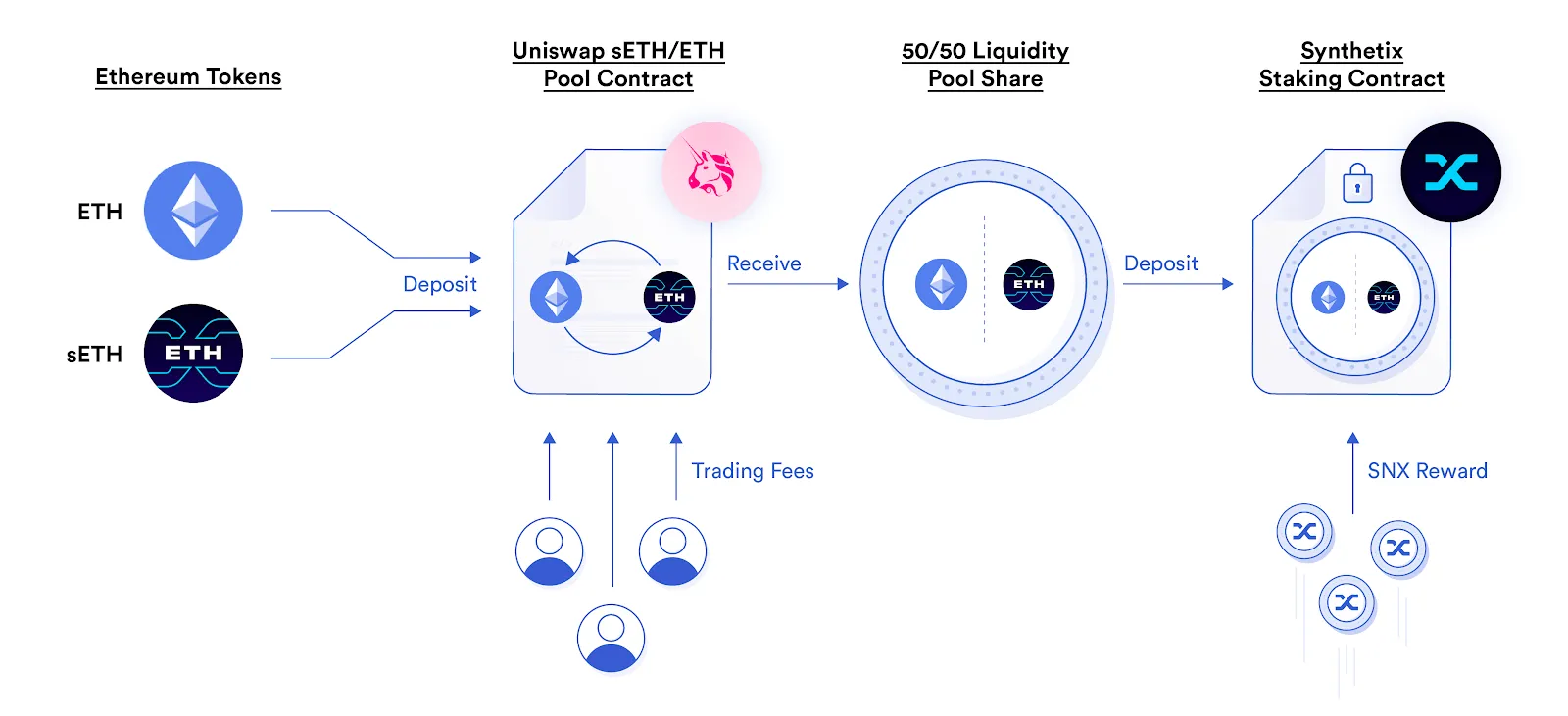

1. Liquidity Provision 💧

You provide your cryptocurrency tokens to a liquidity pool on a DeFi platform. These pools are like digital reservoirs that facilitate trading and other financial activities.

2. Smart Contract Interaction 🔗

Smart contracts automatically manage your deposited funds and calculate rewards based on predetermined rules.

3. Reward Distribution 🎯

You earn rewards in various forms:

- Interest payments 💸

- Governance tokens 🗳️

- Trading fee shares 📈

- Additional crypto tokens 🪙

4. Compounding Benefits 📊

Many farmers reinvest their rewards to maximize returns through compound interest.

🏆 Types of Yield Farming Strategies

1. Liquidity Pool Farming 🏊♀️

- Provide two tokens to create a trading pair

- Earn fees from trades that occur in the pool

- Example: ETH/USDC pool on Uniswap

2. Single Asset Staking 🎯

- Stake one type of cryptocurrency

- Earn rewards in the same or different tokens

- Lower complexity for beginners

3. Governance Token Farming 🗳️

- Participate in protocol governance

- Earn tokens for voting on platform decisions

- Additional utility beyond just rewards

4. Cross-Chain Farming 🌉

- Utilize multiple blockchain networks

- Diversify risk across different ecosystems

- Access unique opportunities on various chains

📈 Popular Yield Farming Platforms

🥇 Top Platforms for 2025:

- Uniswap 🦄

- Largest decentralized exchange

- Multiple liquidity pools

- Strong community support

- PancakeSwap 🥞

- Binance Smart Chain based

- Lower transaction fees

- Multiple farming options

- Compound 🏦

- Lending and borrowing protocol

- Algorithmic interest rates

- COMP token rewards

- Aave 👻

- Multi-collateral lending

- Flash loans available

- AAVE token incentives

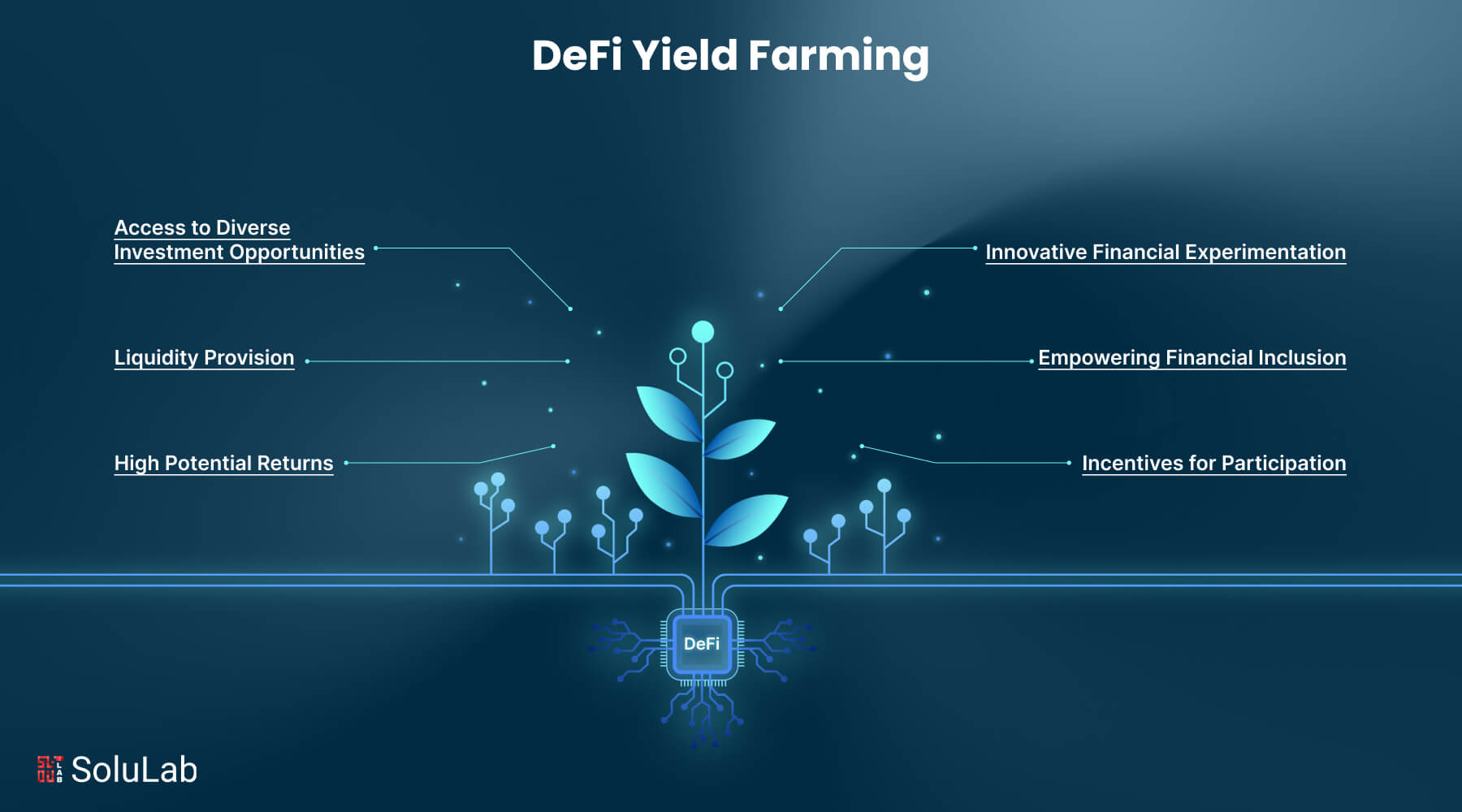

💡 Benefits of Yield Farming

✅ Advantages:

- Passive Income Generation 💰

- Higher Returns than traditional savings

- Decentralized Control 🔓

- Portfolio Diversification 📊

- Innovation Access 🚀

- Community Participation 👥

🎯 Potential Returns:

- Conservative: 5-15% APY

- Moderate: 15-50% APY

- Aggressive: 50%+ APY (higher risk)

⚠️ Risks and Challenges

🚨 Major Risks to Consider:

- Impermanent Loss 📉

- Price divergence between paired tokens

- Potential loss compared to holding assets

- Smart Contract Risks 🔐

- Code vulnerabilities

- Potential hacks or exploits

- Market Volatility 📊

- Cryptocurrency price fluctuations

- Sudden market downturns

- Liquidity Risks 💧

- Difficulty withdrawing funds

- Platform-specific issues

- Regulatory Uncertainty ⚖️

- Changing government policies

- Legal compliance requirements

🎯 Getting Started with Yield Farming

📋 Step-by-Step Guide:

- Research and Education 📚

- Understand DeFi basics

- Study platform mechanics

- Learn about different strategies

- Choose Your Platform 🔍

- Compare fees and rewards

- Check security audits

- Read user reviews

- Set Up Your Wallet 👛

- Use compatible wallets (MetaMask, Trust Wallet)

- Secure your private keys

- Enable two-factor authentication

- Start Small 🐣

- Begin with small amounts

- Test platform functionality

- Learn from experience

- Monitor and Optimize 📊

- Track your returns

- Adjust strategies as needed

- Stay updated on market conditions

🛡️ Safety Tips and Best Practices

🔒 Security Measures:

- Use Hardware Wallets for large amounts

- Verify Smart Contracts before investing

- Diversify Across Platforms 🌐

- Keep Software Updated 🔄

- Never Share Private Keys 🗝️

💰 Risk Management:

- Start with Established Platforms 🏢

- Don’t Invest More Than You Can Lose ⚠️

- Regular Portfolio Reviews 📋

- Stay Informed About Updates 📰

- Consider Insurance Options 🛡️

📊 Yield Farming vs Traditional Investments

| Feature | Yield Farming | Traditional Savings |

|---|---|---|

| Returns | 5-100%+ APY | 0.1-5% APY |

| Risk Level | High | Low |

| Accessibility | 24/7 | Business hours |

| Minimum Investment | Variable | Often $1000+ |

| Liquidity | Varies | Usually high |

🔮 Future of Yield Farming

🚀 Emerging Trends:

- Cross-Chain Integration 🌉

- AI-Powered Strategies 🤖

- Institutional Adoption 🏛️

- Improved User Experience 💻

- Regulatory Clarity 📜

🎯 2025 Predictions:

- Mainstream Adoption will increase

- Better Security Measures will be implemented

- More Regulatory Framework will emerge

- Integration with Traditional Finance will grow

🎓 Common Mistakes to Avoid

❌ Don’t Do This:

- Chasing High APY without understanding risks

- Ignoring Gas Fees calculations

- Not Diversifying your investments

- FOMO Investing in new platforms

- Neglecting Security measures

✅ Do This Instead:

- Research Thoroughly before investing

- Calculate All Costs including fees

- Spread Risk across multiple platforms

- Take Measured Approaches to new opportunities

- Prioritize Security above all else

📚 Advanced Strategies

🎯 For Experienced Users:

- Yield Aggregators 🔄

- Platforms that automatically optimize yields

- Examples: Yearn Finance, Beefy Finance

- Flash Loans ⚡

- Borrow and repay in same transaction

- Advanced arbitrage opportunities

- Leveraged Farming 📈

- Borrow to increase position size

- Higher returns but increased risk

- Multi-Chain Strategies 🌐

- Utilize opportunities across different blockchains

- Diversify ecosystem exposure

🔍 Tax Considerations

📋 Important Points:

- Track All Transactions 📊

- Understand Local Tax Laws ⚖️

- Keep Detailed Records 📁

- Consider Professional Help 👨💼

- Plan for Tax Payments 💰

🌟 Success Stories and Case Studies

📈 Real Examples:

Many yield farmers have successfully generated significant passive income through strategic participation in DeFi protocols. However, it’s important to note that past performance doesn’t guarantee future results.

🎯 Key Success Factors:

- Consistent Research 📚

- Risk Management 🛡️

- Long-term Perspective 🔮

- Community Engagement 👥

- Continuous Learning 🎓

🤝 Community and Resources

📱 Stay Connected:

- Join DeFi Communities on Discord and Telegram

- Follow Yield Farming News 📰

- Participate in Governance 🗳️

- Share Experiences with other farmers

- Learn from Experts 🎓

🔗 Useful Resources:

- DeFi Pulse – Track total value locked

- Yield farming trackers – Monitor APY rates

- Security audit reports – Verify platform safety

- Educational content – Improve your knowledge

👉Binance Academy – Yield Farming Explained

🎯 Conclusion

Yield farming represents an exciting opportunity to earn passive income in the cryptocurrency space. While it offers potentially high returns, it’s crucial to understand the risks and implement proper safety measures.

🔑 Key Takeaways:

- Start small and learn gradually 🐣

- Prioritize security over high returns 🔒

- Diversify your investments across platforms 🌐

- Stay informed about market developments 📰

- Never invest more than you can afford to lose ⚠️

👉 “Check out our beginner’s guide to crypto wallets”

🚀 Next Steps:

- Continue Learning about DeFi and blockchain technology

- Start with Small Amounts on established platforms

- Join Communities to learn from others

- Monitor Your Investments regularly

- Stay Updated on industry developments

Remember, yield farming is not a get-rich-quick scheme. It requires patience, research, and careful risk management. With the right approach, it can be a valuable addition to your cryptocurrency investment strategy.

Disclaimer:

Please note that I am a human and human can make mistakes and this information is for educational purposes only. Nothing in this article should be considered financial or investment advice. Cryptocurrencies are volatile and involve substantial risk of loss. Always do your own research before making any investment decisions. Consult with a qualified financial advisor for personalized guidance.

Please Note:-

CryptoView.live may contain links to third-party websites or external resources purely for informational purposes. We do not control or endorse the content, accuracy, or offerings of any third-party site linked within our platform. Visitors are strongly encouraged to conduct their own research before engaging with any services or content mentioned. The views expressed on CryptoView.live do not constitute financial advice and reflect the opinions of the authors, not necessarily those of the platform itself.

What is yield farming in crypto?

Yield farming is a way to earn passive income by lending or staking your crypto assets in decentralized finance (DeFi) protocols. In return, you earn rewards, usually in the form of interest or new tokens.

How does yield farming work?

You deposit your crypto into a liquidity pool — a smart contract that powers decentralized exchanges or lending platforms. Other users borrow or trade using that pool, and you earn a share of the fees or token rewards.

Is yield farming safe?

Yield farming can be profitable, but it comes with risks like impermanent loss, smart contract bugs, and rug pulls. Always research the platform and start with small amounts.

What are the best platforms for yield farming in 2025?

Some popular platforms include Uniswap, Aave, Curve Finance, and newer Layer 2 protocols like Arbitrum and Base. Always check for audits and community trust before investing.

What’s the difference between staking and yield farming?

Staking usually involves locking a single token to support a network (like Ethereum), while yield farming often involves providing liquidity in pairs and earning rewards from trading fees or incentives.

Can beginners start yield farming?

Yes, but it’s important to understand the risks and start with trusted platforms. Use testnets or small amounts to learn before committing large funds.

xmc886